Jeff Bezos Predicts Gigantic Societal Benefits Despite AI’s ‘Industrial Bubble’

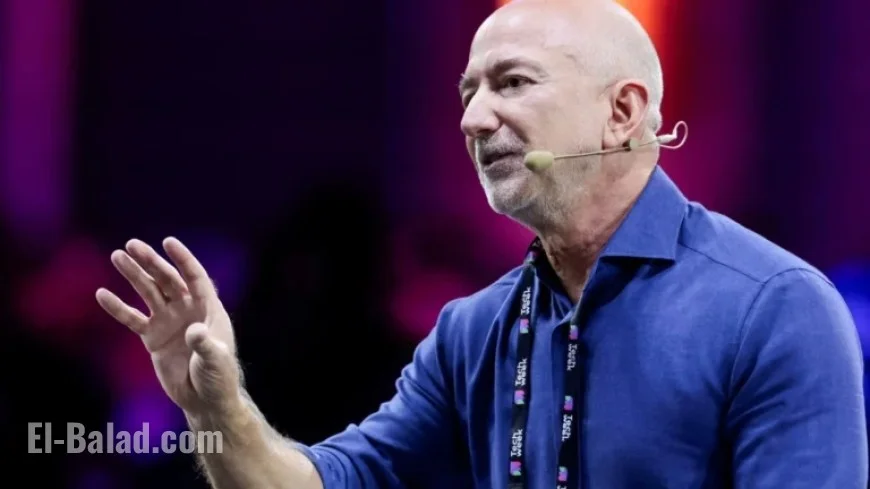

Jeff Bezos, founder of Amazon, spoke on the potential societal benefits of artificial intelligence (AI) during Italian Tech Week in Turin, Italy. He emphasized that AI is currently in an “industrial bubble,” suggesting that while valuations may seem inflated, the technology itself is legitimate and will bring significant advancements to various sectors.

Understanding the AI Industrial Bubble

During his discussion, Bezos defined an industrial bubble as a period where stock prices are disconnected from the actual performance and fundamentals of businesses. He noted the excitement surrounding AI, paralleling it with past market bubbles, such as the dotcom crash of 2000.

Key Characteristics of Industrial Bubbles

- Separation of stock prices from business fundamentals.

- Heightened enthusiasm leading to indiscriminate funding for various projects.

- Challenges for investors in distinguishing between viable and unviable ideas.

Bezos pointed out that current funding trends are unusual, citing instances where small companies are receiving billions in investments. Despite this chaotic environment, he reassured the audience that the core technology of AI is genuine and poised to transcend standard industry practices.

Positive Outcomes from Industrial Bubbles

Bezos illustrated that historical industrial bubbles could yield positive outcomes. He referenced the biotech sector in the 1990s, which, despite many companies failing, contributed to the creation of life-saving drugs.

He suggested that while the AI sector may face risks associated with speculative investments, the eventual winners will lead to substantial societal benefits. “The benefits to society from AI are going to be gigantic,” he stated confidently.

Wider Concerns About AI Investments

Bezos’s insights reflect a broader concern among business leaders. In August, Sam Altman, CEO of OpenAI, voiced similar worries about the AI market being in a bubble. Additionally, Goldman Sachs CEO David Solomon shared his apprehensions regarding stock market conditions amid the AI hype, indicating that a correction may be forthcoming as the excitement subsides.

Karim Moussalem, chief investment officer at Selwood Asset Management, also remarked on the speculative nature of current investments in AI, likening them to significant market manias of the past.

The discussion at Italian Tech Week highlighted the optimism and caution surrounding AI, suggesting a need for careful navigation in a rapidly evolving landscape. Jeff Bezos encapsulated this sentiment by affirming the transformative potential of AI, urging stakeholders to focus on the long-term benefits despite the current speculative atmosphere.