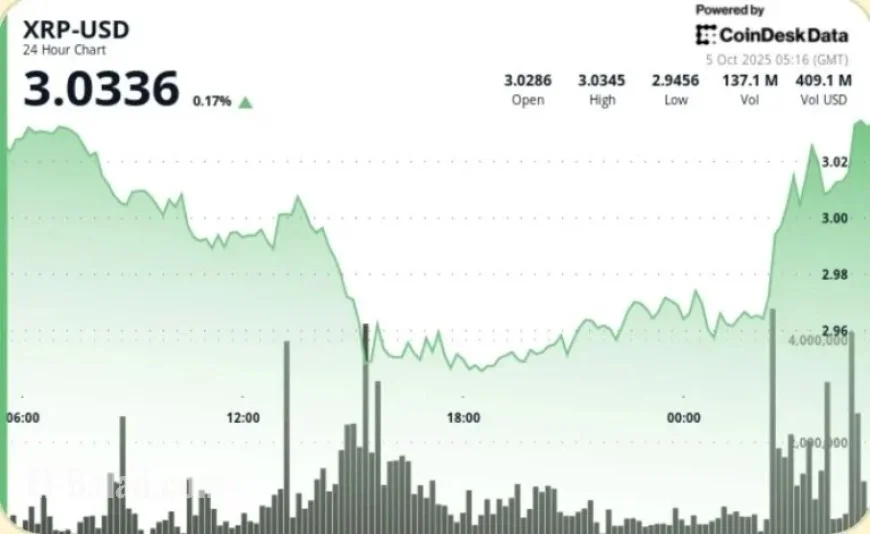

XRP Soars Past $3 as Traders Anticipate $4 Amid Bitcoin Surge

XRP has recently surged past the crucial $3.00 mark in early trading on Sunday in Asia. This rebound follows a notable dip to around $2.95 experienced on Saturday, igniting interest from traders. The swift recovery was largely driven by heavy market activity that cleared out leveraged long positions, allowing for a strong entry from bargain hunters and major investors. Analysts are now closely monitoring the $3.10 to $3.30 range, which is seen as a critical battleground, with breakout projections eyeing the $4.00 to $4.20 levels.

Market Overview and Recent Developments

Several factors are influencing the current price dynamics of XRP:

- Current XRP ETF filings, of which seven are still active, are projected to lead to significant price action as decisions are expected in October.

- Ripple’s partner in Japan, SBI, recently expanded its lending program associated with XRP, enhancing the narrative of institutional integration in Asia.

- The broader cryptocurrency market is experiencing volatility, having faced $1.7 billion in derivatives liquidations. Despite this, XRP wallets saw an influx of over 160 million tokens last week.

Price Action Summary

Recent price movements paint an intriguing picture for XRP:

- Resistance was observed at $3.03 on October 4, marking a significant trading cap.

- A breakdown to $2.95 during peak hours occurred with a trading volume of 122 million tokens, tripling the average.

- Following this, stabilization around $2.96 to $2.97 set the stage for recovery in the Asian trading session.

- By Sunday morning, XRP decisively moved past the $3.00 threshold, converting it into a level of support.

Technical Analysis Insights

Traders are considering various technical aspects for XRP’s next movements:

- Support Level: A fresh base at $2.95 to $3.00 is currently being maintained through significant accumulation.

- Resistance Level: The short-term cap remains at $3.03, with $3.30 identified as the breakout zone.

- Trend Indicators: An inverse head-and-shoulders pattern seen on higher timeframes suggests potential targets of $4.20 to $4.80, provided that the $3.30 resistance is breached.

- Volume Trends: Recent flushout volumes signal strong market rotation with resumed accumulation noted during Asian trading hours.

- Momentum Indicators: The Relative Strength Index (RSI) in the mid-50s points to a neutral-to-bullish sentiment, while the MACD is trending toward a bullish crossover.

What Traders Are Watching

As the market evolves, traders are keenly focused on several key factors:

- The ability of XRP to maintain closes above the $3.00 level, potentially establishing a base for a climb towards $3.30 to $3.50.

- The impending decision from the SEC on ETF filings scheduled for October 18, which could significantly affect altcoin prices.

- Movements in whale wallets and changes in exchange reserves as indicators of market positioning.

- The macroeconomic climate, especially the Federal Reserve’s strategies and liquidity dynamics in Asia, which shape market risk appetite.