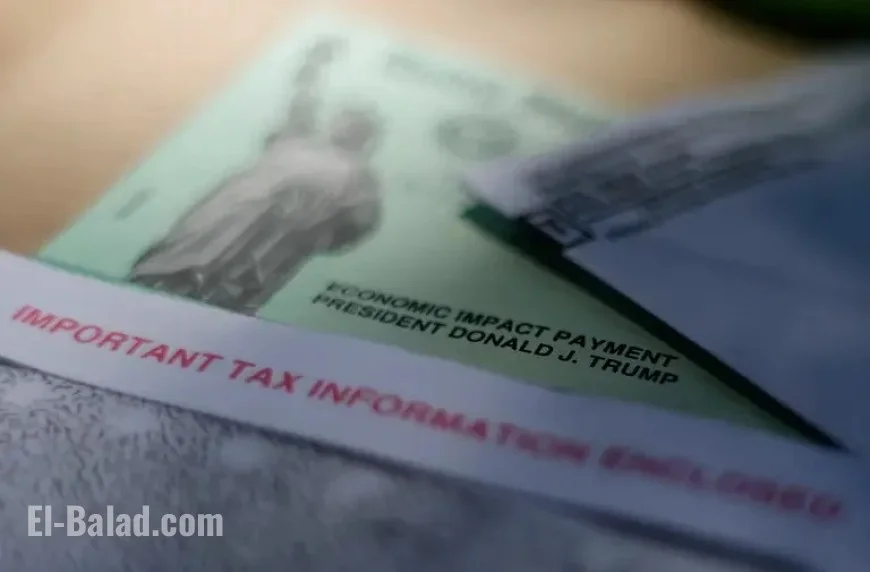

Trump’s Plan to Phase Out Paper Checks: How It Affects You

The United States government has initiated a phased elimination of paper checks for many payment programs. This significant change began following an executive order signed by President Donald Trump in March, impacting beneficiaries of Social Security, Supplemental Security Income (SSI), and tax refunds. Advocates express concerns that this transition may adversely affect marginalized Americans who lack access to digital services.

Impacts of Phasing Out Paper Checks

Jennifer Burdick, a supervising attorney at the SSI unit of Community Legal Services in Philadelphia, highlighted the challenges faced by many beneficiaries. “Many applicants move and do not always receive their mail,” she noted. Burdick added that most of her clients learned about the transition only through her guidance.

Statistics on Beneficiaries

Approximately 10% of Burdick’s clients rely on paper checks. Concerns are particularly notable for new beneficiaries who need paper checks to open bank accounts. Currently, nearly 400,000 Social Security and SSI beneficiaries receive their payments via paper checks. This figure represents less than 1% of the 70.6 million retirees, disabled individuals, and children receiving Social Security benefits.

- 10% of Burdick’s clients receive paper checks.

- 400,000 beneficiaries rely on paper checks.

- Less than 1% of the total 70.6 million beneficiaries receive paper checks.

Alternative Payment Methods

In place of paper checks, beneficiaries will be transitioned to direct deposit or to a Direct Express card, designed for those without bank accounts. Nevertheless, the Social Security Administration (SSA) stated that it will continue to issue paper checks if no other payment method is available. “When a beneficiary has no other means to receive payment, we will continue to issue paper checks,” remarked SSA representatives.

Challenges for Vulnerable Populations

Kathleen Romig from the Center on Budget and Policy Priorities indicated that the individuals most impacted by this change generally lack bank accounts or stable housing. Many do not possess the skills or tools to effectively engage with digital services.

Several factors contribute to their reluctance to switch payment methods. Some struggle with mental health issues that lead to distrust of financial institutions, while others do not have sufficient funds to open a bank account.

Need for Thoughtful Transition Management

Nancy Altman, president of Social Security Works, labeled the gradual removal of paper checks as unnecessary. “If not managed properly, it will be devastating for those unaware of the change and living on limited incomes,” she stressed. Altman believes that everyone should have the option to receive a paper check. Even if the percentage of beneficiaries reliant on paper checks is small, it still represents a significant number of individuals who could be adversely affected.