Tesla Stock Surges: What the Latest Price of a Share of Tesla Stock Reveals About Investor Confidence and Market Risks

Discover the latest price of a share of Tesla stock, why analysts are raising their targets, and what upcoming earnings and deliveries mean for investors in 2025.

The price of a share of Tesla stock has been making headlines once again as Wall Street analysts, delivery forecasts, and insider moves reshape investor sentiment. Hovering around $440.40, Tesla’s stock remains one of the most closely watched in the market, with bullish upgrades pushing optimism higher, even as challenges in Europe and concerns about valuation add complexity to the story.

Current Price and Market Snapshot

Tesla’s share price currently trades at approximately $440.40. For context, here’s how the stock looks against its recent history:

| Metric | Value |

|---|---|

| Current Price | $440.40 |

| 52-Week High | $488.54 |

| 52-Week Low | $212.11 |

This trading range highlights just how volatile Tesla stock has been, offering both big opportunities and sharp risks for investors.

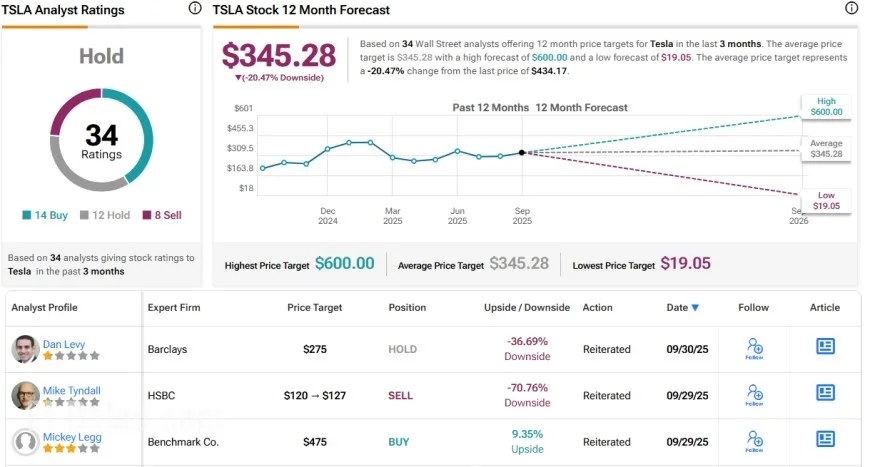

Why Analysts Are Raising Price Targets

Several firms have recently boosted their outlook on Tesla, citing not only its automotive dominance but also its growing bets on AI and robotics.

-

Wedbush raised its target to $600, calling Tesla a leader in autonomous vehicle technology.

-

Canaccord lifted its target to $490, pointing to strong third-quarter deliveries and energy business growth.

-

Piper Sandler reaffirmed an “Overweight” stance with a new target of $500, reinforcing bullish momentum.

These upgrades show how sentiment has shifted from doubt to renewed optimism, fueled largely by Tesla’s ability to exceed expectations in both vehicle deliveries and technology strategy.

Q3 Deliveries Expected to Be Strong

One of the most immediate catalysts for the stock is Tesla’s upcoming delivery report. Analysts estimate deliveries between 447,000 and 483,000 vehicles in Q3, reflecting growth from Q2.

Key factors driving demand include:

-

Expiration of the $7,500 U.S. EV tax credit in September, pushing last-minute buyers.

-

Continued strength in Tesla China, which has been a growth engine for global deliveries.

This upcoming report will likely be a decisive moment for the price of a share of Tesla stock, as deliveries often set the tone for earnings and investor sentiment.

Insider Confidence: Musk’s Billion-Dollar Buy

In a bold move, Elon Musk purchased nearly $1 billion worth of Tesla shares in mid-September, buying 2.57 million shares at prices between $372 and $396. This rare insider purchase from Musk sent a strong signal of confidence to the market and helped fuel a surge in premarket trading.

When the CEO himself doubles down, investors often follow, interpreting such moves as a clear vote of confidence in the company’s long-term vision.

The Risks Tesla Still Faces

Despite bullish targets, Tesla is not without challenges.

Weak Sales in Europe

Tesla’s European operations have struggled, with sales down 37% year-over-year in August 2025 and a 43% decline year-to-date. This sharp drop highlights regional weakness that could weigh on global performance.

Expiring Incentives

The end of EV subsidies in key markets may slow demand. Without government support, Tesla will need to prove its ability to sustain growth based on consumer demand alone.

Valuation Concerns

Tesla continues to trade at high multiples compared to traditional automakers. While this reflects expectations of innovation, it also leaves little room for disappointment if deliveries or earnings miss forecasts.

Investor Outlook and Market Expectations

The coming weeks will be critical for Tesla. Analysts see potential upside to the $490–$600 range, but much depends on Q3 earnings and delivery numbers. If Tesla outperforms, the price of a share of Tesla stock could continue its climb. On the other hand, weak European performance or signs of slowing demand could drag the stock lower.

For now, the combination of analyst upgrades, Musk’s insider purchase, and strong U.S. and China deliveries suggests that Tesla remains at the center of investor focus heading into the final quarter of 2025.