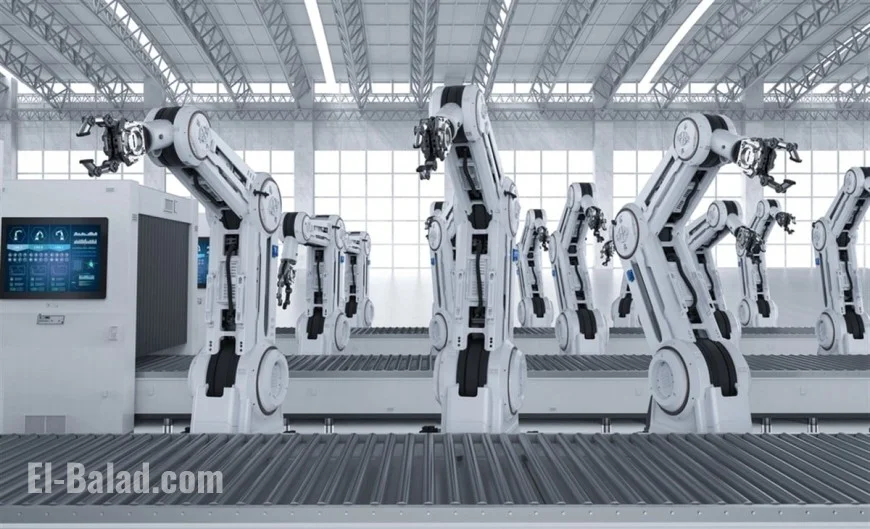

Discover Why Richtech Robotics Could Be the Future Star of the Automation Industry

Richtech Robotics Emerges as a Key Player in the Technology Sector

Richtech Robotics Stock Soars with Market Confidence

On September 22, Richtech Robotics, listed on NASDAQ under the ticker RR, experienced a significant stock surge of nearly 25%, reaching an impressive 52-week high. This rally was accompanied by a substantial increase in trading volume, exceeding 75 million shares compared to its three-month average of about 17 million. Such remarkable market activity points to a fundamental shift in investor perception regarding the company’s future prospects.

Strategic Partnerships Enhance Richtech’s Market Position

The catalyst for this bullish trend was an analyst price target upgrade by H.C. Wainwright to $6.00 per share. This revision mirrors Richtech’s progress in securing strategic business agreements that demonstrate its transition from potential to proven market execution.

One of the significant achievements includes a Master Services Agreement with a leading U.S. automotive dealership, reportedly AutoNation. This successful pilot program underscores the efficiency of Richtech’s logistics robots in the automotive sector, opening doors to scalable revenue opportunities.

Further, the company entered a services agreement with a major global retailer on August 21. This milestone affirms Richtech’s capability to meet the intricate demands of large enterprise clients, enhancing its strategic shift to a Robots-as-a-Service model that promises predictable and recurring revenue streams.

Automation Trends Drive Richtech’s Growth

As companies grapple with persistent labor shortages and wage inflation, automation has become a necessity. Richtech’s robots, including the ADAM beverage robot, DUST-E cleaning units, and Titan logistics movers, provide effective solutions to these challenges, allowing businesses to improve efficiency and reduce costs.

This alignment with global automation trends positions Richtech as a beneficiary of a long-term secular market shift, supporting a positive growth outlook.

Financial Strength Supports Strategic Expansion

Despite not yet reaching profitability with a reported net loss of $4.06 million in the third quarter of 2025, Richtech’s strategic investments in research and market penetration are indicative of its growth ambitions. The company’s robust financial position, with over $85 million in cash and minimal debt as of June 30, 2025, provides a solid foundation for future expansion.

Richtech’s strong balance sheet and current ratio exceeding 120 highlight its ability to support large-scale partnerships without resorting to dilutive financing solutions.

Analyst Insights and Market Predictions

| 12-Month Stock Price Forecast | Current Price |

|---|---|

| $4.50 | $4.20 |

| High Forecast: $6.00 | Average Forecast: $4.50 |

| Low Forecast: $3.00 | 7.14% Upside |

The rally in Richtech Robotics stock signifies a market re-rating driven by transformative deals and strong validation from Wall Street. Positioned firmly within the growing automation trend, the company is evolving from a research-focused firm into a robust, commercially validated enterprise.

For potential investors, Richtech Robotics offers a compelling investment opportunity, warranting attention and consideration for portfolio inclusion.